How is a mortgage different from other types of loans?

Whether you’re planning to buy a home, finance a new car, or need some cash in a pinch, many different types of loans help you achieve your goals. But with so many different kinds of loans available, how do you decide which loan’s right for you? More importantly, how do you make financial decisions that’ll protect, not hurt, your future? In this blog, we’ll do our best to give you the information you need.

What are the different types of loans?

There are many loan types out there, but the most popular ones are:

- Mortgages: These are secured loans used to finance the purchase of real estate. They are long-term loans with lower interest rates than unsecured loans because they typically use the property being purchased as collateral.

- Personal loans: People will use these unsecured loans for all sorts of personal expenses, such as debt consolidation, home improvements or travel. Typically, these loans have higher interest rates, shorter repayment terms and do not require collateral.

- Car loans: These are secured loans specifically for purchasing vehicles. As with mortgages, the purchased vehicles serve as collateral, typically resulting in lower interest rates than unsecured loans.

How do different loans compare?

Each different type of loan is tailored to the borrower's needs and designed to accomplish a specific purchase. Here’s what that may look like:

| Loan type | Mortgage | Personal loan | Car loan |

|---|---|---|---|

| Purpose | Purchase of real estate | Cover personal expenses | Purchase of a vehicle |

| Avg loan term | 15-30 years | 1-7 years | 3-8 years |

| Interest rates | Typically lower due to collateral | Higher, as it's unsecured | Lower, but higher than mortgages |

| Collateral | Yes, the property being purchased | No collateral required | Yes, the vehicle being purchased |

| Loan amount | Generally larger due to property prices | Smaller amounts based on borrower’s need | Based on the cost of the vehicle |

How is a mortgage different from other types of loans?

A mortgage is a long-term loan designed just for buying real estate, usually lasting 15 to 30 years. Unlike personal loans, which are unsecured and can be used for almost anything, or car loans, which are only for vehicles, a mortgage uses the property you’re buying as collateral.

This often means lower interest rates, but it also involves a more detailed application process and a bigger financial commitment. Mortgages are specifically for real estate, making them a unique tool for anyone looking to own property.

What types of mortgages are available?

A mortgage is one of the most significant transactions of your life. By working with a quality mortgage lender, you’ll get access to a variety of loan programs designed to fit your needs and goals.

But with all the incredible loan options available, how can you decide what type of mortgage is best for you? It starts with knowing the difference between these common types of mortgages:

Fixed-rate mortgage or adjustable-rate mortgage (ARMs)

- Fixed-rate mortgages provide a stable interest rate throughout the life of the loan, offering long-term homeowners consistent and predictable monthly payments.

- Adjustable-rate mortgages (ARMs) begin with a lower interest rate that fluctuates over time based on market conditions. This makes them an appealing option for short-term homeowners or those planning to refinance before the rate goes up.

Conventional or Government-backed loans

- Conventional loans are non-government-backed mortgages that follow Fannie Mae and Freddie Mac guidelines, making them a popular choice for borrowers with good credit and a stable financial history. They offer competitive interest rates and flexible terms.

- Government-backed loans like FHA, VA, and USDA loans are insured by the government, making them easier to qualify for, especially if you’re a first-time homebuyer or a veteran. These loans come with lower credit requirements and are designed to help more people achieve their dream of homeownership.

How is a personal loan different from a mortgage?

Mortgages are only used for one purpose: purchasing property. The property being purchased is used as collateral, which means the lender can provide large sums of money with lower interest rates over long terms (up to 30 years).

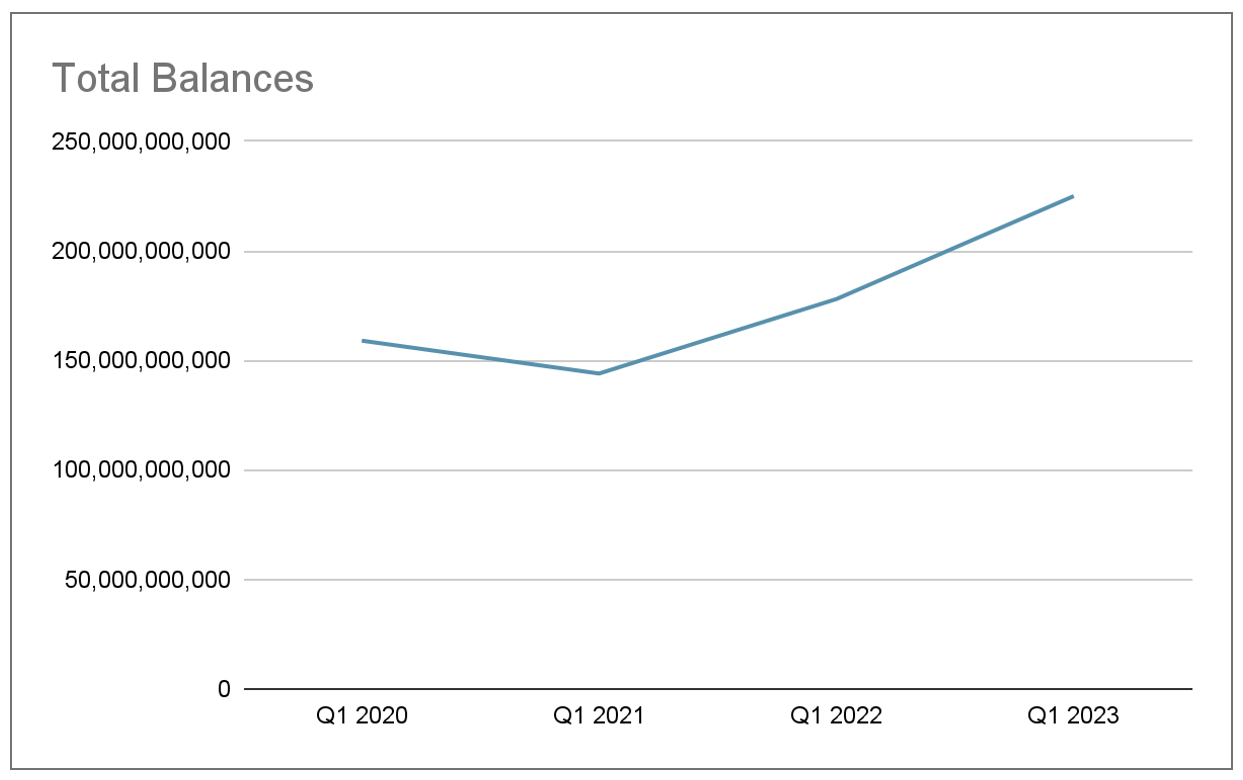

Personal loans are very different. Think of them like the Swiss Army Knife of lending. They’re easy to get and accomplish all sorts of financial goals, but they aren’t ideal for major purchases like a home or property. However, that’s not stopping people from getting them at record rates:

Q1 2023 personal loan trends

What to expect with personal loans

- Unsecured: In most cases, personal loans don’t require any collateral. That means you won’t have to put property or other assets on the line to secure a loan. While this makes them accessible to more borrowers, it also means more risk for the lender and higher interest rates for the borrower.

- Flexible use: One of the main advantages of personal loans is their versatility. Unlike mortgages or car loans, personal loans are different and can be used for almost any expense. This includes medical bills, major purchases like a new appliance or even vacations.

- Quick approval: Personal loans have a faster approval process compared to mortgages, with some lenders offering same-day approval and funding.

- Fixed interest rates: Most personal loans have fixed interest rates and predictable payments over the life of the loan.

- Flexible loan terms: In many cases, a personal loan lender will offer a range of repayment terms, allowing you to choose a schedule that fits your budget and financial goals.

How is a car loan different from a mortgage?

Mortgages have one thing in common with car loans: collateral. Both use the item being purchased as security for the loan. However, they’re used for very different purposes.

Mortgages are for purchasing property and offer large loan amounts with lower interest rates spread over long terms. Car loans, on the other hand, are only used for buying vehicles. They also come with lower interest rates thanks to the collateral, but the loan amounts are smaller, and the repayment terms are much shorter, usually between 3 to 7 years.

What to expect with car loans

- Depreciation: Cars are a depreciating asset. That means they lose value over time. So, the speed of depreciation will be an important factor to consider when taking out a car loan. To best protect your financial future, make sure the vehicle you purchase will not decrease in value faster than your loan pays it off.

- Secured loan: Like a mortgage, a car loan is a secured loan, and the vehicle itself becomes the collateral. This generally results in a lower interest rate compared to unsecured personal loans. However, if borrowers fall behind on their payments, the lender does have the right to repossess the vehicle.

- Interest rates: The interest rate on a car loan can be affected by several factors. These include credit score, down payment, loan term, vehicle age, and the type of vehicle being purchased.

Navigating the different loan types

When considering a loan of any type, it’s important to know how the loan works, what to expect, and how much interest you’ll pay over the life of the loan. This empowers you to make smart decisions that will help you achieve your near and long-term financial goals.

If you hope to become a homeowner, it’s also worth noting that every loan will affect your credit score, debt-to-income ratio and financial readiness. These factors play critical roles in your mortgage application’s purchasing power and approval.

So before you sign on the dotted line, we recommend you connect with a loan officer to get a clear path to achieving your homeownership dreams.

The above information is for educational purposes only. All information, loan programs and interest rates are subject to change without notice. All loans subject to underwriter approval. Terms and conditions apply. Always consult an accountant or tax advisor for full eligibility requirements on tax deduction.